How do marketers’ message to consumers at a time where prices are rising faster than they have in decades? In this post, we’ll break down the latest numbers on how multicultural consumers are responding to price fluctuations in the economy with the bimonthly survey data from the Cultural Inclusion Accelerator™ Tracker from June – October 2022. Marketers should understand that many multicultural consumers are not seeing economic times as tough as some marketing executives may see them, and that multicultural consumers are hopeful for the future. Multicultural consumers are young and often aspirational and overall, more positive about the future. Gen Z and Millennials are seeing some of the strongest labor market conditions of their lifetimes and early or in the middle of their careers. Some months in 2022 have even hit all-time lows in unemployment for Hispanic consumers and Disabled consumers. In the Cultural Inclusion Accelerator™ Tracker, consumers see signs of hope that they can achieve goals for themselves and their households. The strong labor market has shifted power toward younger, more multicultural consumers and if budgets need tightening the best thing a marketer can do now and in the future is build trust with these younger diverse consumers.

The Economic Experience of Different Groups

Asian consumers’ fast-growth and high-income present excellent opportunity for marketers

Asian American consumers are different from other multicultural groups in a lot of ways while also being incredibly diverse themselves. This can make them a challenging segment for marketers. According to Pew Research, the median household income for Asian Americans was $85,800 in 2019, far higher than the median of $61,800 among all households[1]. Yet the Asian segment also has a high proportion of people in poverty. For a segment that makes up less than 10% of the US population this presents a challenge for marketers to understand that complexity. However, they are also the fastest growing single segment in the United States and with that higher median income they are generally more insulated from some of the worst of inflation.

Asian views in the Cultural Inclusion Accelerator™ Tracker of the current job market, the next six months, and of their income all trended upward in August compared to June in the Cultural Inclusion Accelerator™ Tracker, and then returned to their June levels. However, overall Asian consumers feel net positive about the economy.

For June and August, Asian consumers viewed gas as the most important consideration in making household decisions. In October, the cost of groceries became the central consideration for Asian consumers. But far from cutting their grocery budget, Asians were most likely to say they are going to spend more money on groceries regardless of what they might be cutting back on[2]. While the category Asian consumers are most likely to sacrifice in their budget are restaurants.

A strong labor market propels Black consumers into greater opportunities for brands

Black consumers on average have seen their incomes rise in 2022[3] and this rise has been faster than other groups. For the median Black consumer this has been an even faster growth than inflation for much of the year, with some evidence that Black workers have been able to transition to higher paying industries from before the pandemic[4]. Though they see household costs rising, Black consumers are optimistic about the economy.

The number one major factor in the Cultural Inclusion Accelerator™ Tracker for making purchasing decisions for consumers changed in August for most segments. For Black consumers groceries overtook gas prices as the number one factor in making purchasing decisions as gas prices declined and the price of food continued to rise[5]. In October, groceries continued to be the major factor for Black consumers. Black consumers are 16% more likely than White Non-Hispanic consumers to say that their grocery bill is a major factor in making overall household decisions. Marketers should be mindful of this potential sensitivity to price while marketing to Black consumers.

Overall, Black consumers are also more likely to be impacted by inflation in the housing market since about half of Black adults are renters compared to around one in five White Non-Hispanics[6]. Homeowners are often shielded from most month-to-month changes in housing costs by fixed mortgages, but renters more immediately bear the burden of changes in housing costs. Further, 54% of Black renters are either moderately or severely burdened by housing costs,[7] 26% more than White Non-Hispanic renters. The Cultural Inclusion Accelerator™ Tracker reflects this reality and identifies rent as the second most important cost consideration in making household purchasing decisions after groceries for Black consumers, 18% more of a priority than White Non-Hispanics.

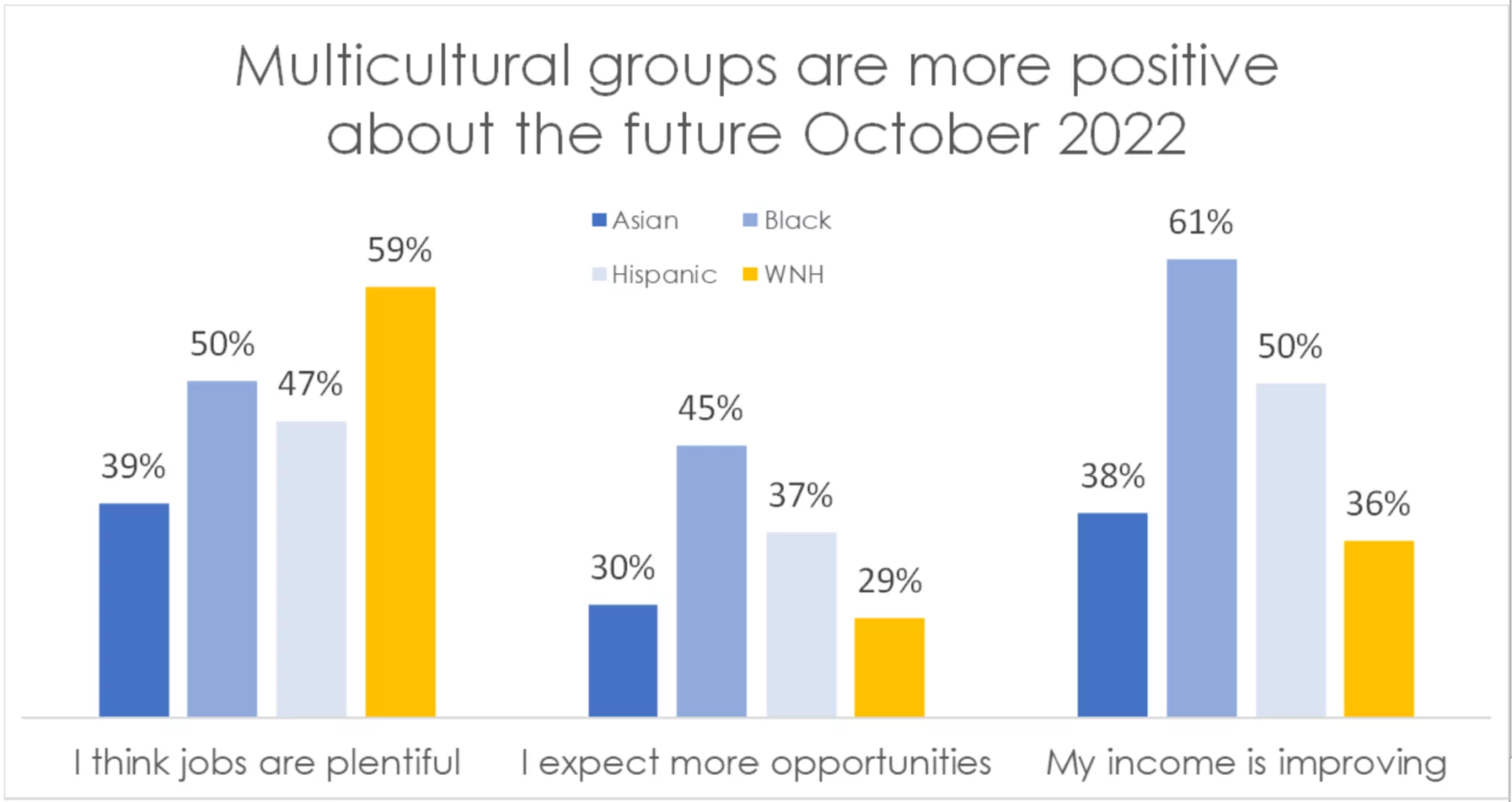

However, the Cultural Inclusion Accelerator™ Tracker shows Black consumers are also the most optimistic about their household income rising in the next six months. From October, Black consumers are 1.7 times as likely as White-Non-Hispanics to say their incomes are going to improve over the next six months, the most of any segment. Black consumers are benefiting from a strong labor market as well, over half of Black consumers in the Cultural Inclusion Accelerator™ tracker say that jobs are plentiful, up from 43% in June and the largest shift of any segment.

Hispanics’ broad base and all-time low unemployment underscores segment’s importance for marketers

Hispanics have a lot of the same experience as Black consumers. Groceries are the number one factor in the Cultural Inclusion Accelerator™ tracker for household decisions for Hispanics – with 16% more Hispanics than White Non-Hispanics saying groceries are a major factor in purchasing decisions. Like Black consumers, Hispanics are more than twice as likely to be renters compared to White Non-Hispanics.

Despite these challenges, the Cultural Inclusion Accelerator™ tracker shows the same resilience among Hispanic consumers. Hispanics are 1.4 times as likely as White-Non-Hispanics to say their incomes are going to improve. Hispanics are 19% more likely in August to say their local job market will improve in the next 6 months compared to June, a larger jump than any other segment that persisted through October, possibly driven by Hispanic unemployment levels hitting all-time lows during that period.

Ultimately then, Hispanics are in a similar situation to Black consumers. Hispanics consumers are wary of inflation but optimistic about their current economic situation. Hispanics are feeling more secure about the availability of jobs around them than they were earlier this year due to the strong labor market.

Multicultural consumer resiliency and aspiration drive 2023 opportunities for brands

The current consumer confidence among multicultural consumers presents an opportunity to marketers. Since April 2020, the bottom half of earners has continually outpaced inflation and inequality has fallen for the first time in a long time[8]. When making purchasing decisions multicultural consumers are optimistic and evidence in the Cultural Inclusion Accelerator™ tracker shows that optimism is rising or steady this year among the multicultural segments.

The Cultural Inclusion Accelerator™ tracker doesn’t currently indicate that the multicultural consumers are purchasing more given this optimism. As the percentage of multicultural consumers saying they were intending to purchase or spend more across all categories on purchases like entertainment, hotels, home appliances, cars, and clothes dropped from June through October, although average purchase intent for ads tested through CIIM™ rose across industries during that same period[9]. Some of the additional disposable income consumers find themselves with may be going to more savings[10] or paying off more loans. But as multicultural consumers save more, their future purchasing power goes up and it becomes even more crucial for brands to build trust with them through cultural relevant marketing.

Footnotes:

[1] Key facts about Asian Americans | Pew Research Center

[2] Each segment was asked individually about different categories of spending whether they would spend more or less – groceries had the highest percentage of Asians saying they were going to “spend more” on the category compared to other category no matter which category they said they were going to “cut back” on (except of course for those who said they were going to cut back or spend the same amount on groceries)

[3] Employed full time: Median usual weekly real earnings: Wage and salary workers: 16 years and over: Black or African American (LEU0252884600Q) | FRED | St. Louis Fed (stlouisfed.org) Median

[4] Pandemic Shifts in Black Employment and Wages – The White House

[5] This tracks with data on price changes over the month of August as while overall month to month inflation was 0.1% (1.2% annualized) from August to September, food prices went up .8% (10% annualized). Gas prices began to rise again in October after 3 months of falling from June peak (BLS.gov)

[6] MRI Simmons 2022; Housing costs increased .7%, around 9% annualized

[7] RENTER COST BURDENS BY RACE AND ETHNICITY (1B) | Joint Center for Housing Studies (harvard.edu)

[8] Realtime Inequality

[9] We do not track every ad in the market but do get a cross section of industries. The rise in Purchase Intent has been across industries and is paired with a rise in cultural relevance.

[10] U.S. consumer sentiment rises back above the 50-point mark | Ipsos